EV Power Electronics Cost Analysis

By Chris Whaling

At the component level, the electrical propulsion system of a hybrid electric car leverages off-the-shelf power electronics, including inverter or converter components, which were initially designed for high-volume applications, such as industrial power generation, wind or solar power converters. This approach helps automotive suppliers to reduce costs. However, the automotive power electronics context also comes with unique design and manufacturing benchmark challenges for suppliers. These challenges are key cost drivers – for example, the costs of ever-smaller power electronics package volumes, wider operating temperature ranges, greater vibration- and under-the-hood environmental control capabilities, and increasingly robust meantime-to-failure testing are not small. All of this means that while automotive hybrid electric power electronics start from a commodity industrial base, they must thrive in a world of highly specialized design and manufacturing parameters and these requirements drive costs up.

This article is the second in a series based on the work being performed by Synthesis Partners through sponsorship from the Department of Energy’s Vehicle Technologies Office (thank you Mr. Steven Boyd and Ms. Susan Rogers for their permission to share the data and findings in these articles). In our first article (link), we provided a review of the power electronic systems as one of the major components in hybrid cars. In an upcoming article, we will address the role of Wide Bandgap (WBG) devices in automotive applications.

In this article we will present some of the results of a case study carried out by Synthesis Partners to collect, analyze, and integrate data on automotive traction drive inverter cost drivers. The cost analysis of this case study is limited to the manufacturing cost trends in the electrical propulsion system of hybrid cars. There could be power electronics and controls used for the electrical accessories of the car, but these are beyond our analysis scope. In addition, most of hybrid vehicle cost literature is focused on the battery – as it properly should be, given the significant share of overall EV vehicle costs represented by the battery. However, power electronics constitute almost a quarter of the cost of the hybrid propulsion system [including the power electronics (inverter and converter) battery and motor], and a smaller and cheaper inverter can therefore lower the cost of hybridization – no matter the range of the vehicle. Battery costs are largely scaled to battery size, and battery size reduction is a strategic choice about the range of the electric propulsion system. By contrast, inverter cost reduction is needed and can be addressed by suppliers no matter the range of the vehicle, and (like batteries) can be accomplished through revolutionary and/or evolutionary changes to designs or manufacturing techniques. We addressed these topics through our recent research on:

Power electronics cost structure and cost drivers

Power electronics component costs

Individual component costs in a representative traction drive inverter

In order to address these, Synthesis Partners carried out case studies based on data gathered from inverter manufacturers. In the following sections we will be discussing some of the results of this study and we will also provide a flavor of the challenges associated with cost reduction of automotive power electronics.

Case study

The cost of traction drive inverter depends on its design specifications, which in turn is determined by the application’s specific drive cycle performance needs. The performance requirements include many variables such as operating temperature, peak and continuous power, size and weight. Today most hybrid automotive inverter designs incorporate both the motor inverter and generator inverter into the traction drive inverter unit. This is the configuration, used by Toyota in their current hybrid vehicles, making it the primary inverter configuration in use today. These inverters have a maximum voltage rating in the 600V to 1200V range. The output power and frequency (measured in Hertz, or Hz) are managed by the power control units (PCU), which regulates to meet the requirements.

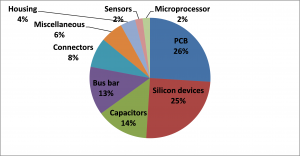

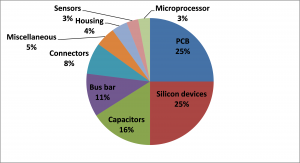

This case study focuses on the manufacturing cost analysis elements (the sum of costs of all resources consumed in the process of making a product), with plant and overhead cost considerations added to manufacturing costs, as feasible (which is to say, factory cost). Figures 1 and 2 shows the current and future cost break down obtained from two inverter companies. The cost information from the first (Figure 1) relates to a dual-inverter system that is a 800V (rated for up to 1200V IGBTs; current rating not specified) bus cap-capable inverter assembly currently in production,, while the second company’s cost drivers (Figure 2) are based on the projected costs for a high-performance inverter unit (which may use a single inverter for both motor and generator, and in that sense be considered “dual”) currently in the design and testing phase which should be in production in the next three to five years. Further specification details of the second inverter were not provided since it is still being prototyped.

|

|

| Figure 1: Current EV propulsion system power electronics component cost breakdown | Figure 2: Future (2015) EV propulsion system power electronics component cost breakdown |

From Figure 2 it can be seen that thermal management is one of the major cost drivers in future as compared to the current scenario shown in Figure 1. One of the main reasons is that it is believed that in future, most of the inverters would be developed for a heavy-duty vehicle. Based on this and current production, Figure 2 shows best-available cost-driver data. Nevertheless, in the current case, thermal management is not (or is much less) driven by the limitations of custom, automotive electronics packaging and small, under-the-hood air flows. It is also true that this inverter is a high performance system suited to temperature extremes in heavy-duty applications, and therefore thermal management (however achieved) is certainly a critical factor in its long-term fail-safe operation. Accordingly, this inverter is believed to be a reasonable approximation regarding distribution of cost-drivers for current, real-world inverter production environments.

Combining the thermal management and housing/structures drivers from Figure 2 gives a total of 21 percent for these items, compared with just four percent for housing/structures (and thermal management) in the inverter in Figure 1. The housing of this unit is much simpler, basically an aluminum box, while the housing reflected in Figure 2 is more complex and is custom-designed for the application. Also, the inverter in Figure 1 is made to be installed away from the internal combustion engine while the inverter in Figure 2 is an under-hood unit and has to compensate for the higher-temperature operating environment.

The other major difference in the cost drivers is in bus bars, which is shown in Figure 1 as a major driver while Figure 12 includes them in the connector cost driver. This may be due to the specific manufacturer’s design which minimizes bus bar interconnects and uses circuit boards with integrated bussing. Also, the heavy-duty applications for which the inverter in Figure 1 is specifically designed may require heavier or more complex bus bar design.

Cost reduction: present and future challenges

A number of factors are creating conditions for potential supply chokepoints and increasing costs in inverter manufacturing, like limited US domestic manufacturing capacity, increasing demand for inverter due to other applications like solar, wind, etc., and increasing cost of capacitors. In terms of specific materials and subcomponents, copper and cooling systems have been in particularly limited supply. This appears to be driven more by limited manufacturing capacity at market-competitive price points than inherent technical limitations on the production of these components or supply constraints. On the other hand, higher-production volumes, innovative manufacturing technologies and new developments like wind band gap devices and customized converters for automotive applications may reduce the inverter cost.

Today, much of the automotive power electronics research is focused on assessing the applicability of wide band gap semiconductor devices in automotive sector. So far there is no clear answer to this question and some of the main challenges are mainly associated with identifying the right set of device and converter topology for automotive application. For example, today Silicon Carbide (SiC), one of the new devices being explored, is very expensive. But SiC devices have some advantages like lower losses, which might reduce the thermal management costs and even increase power rating if a right converter topology is used. As of now, exploratory research is being undertaken to propose and design new converter topologies that can exploit the uniqueness of SiC technology. In addition, it is still not clear if SiC based converter is better than the upcoming converter topologies based on MOSFETs or IGBTs (insulated-gate bipolar transistors) or gallium nitride (GaN) devices.

Given the vast amount of research activity and issues associated with wide band gap semiconductor devices, we will be having a separate set of articles discussing the different aspects in detail.

References

Steven Boyd, “Technology and Market Intelligence: Hybrid Vehicle Power Inverters Cost Analysis, Prepared for the Department of Energy by Synthesis Partners, LLC, Contract Number: DE-DT0002121, July 2011.

Christopher L. Whaling is co-founder of Synthesis Partners, LLC, a private business and technology analysis company based in Reston, VA. Mr. Whaling has lead assessment teams in all source research, analysis and delivery of technology and market intelligence decision-support products for 20 years. Recently, Mr. Whaling refined and implemented Natural Language Processing (NLP) technology to produce beta-level, scalable decision-support systems. Mr. Whaling has been invited to present analysis products, forecasting techniques and outcomes at the US National Intelligence Council (NIC), the Society for Competitive Intelligence Professionals (SCIP), the Washington Institute for Operations Research and Management Sciences (INFORMS), and the US Department of Energy’s Oak Ridge National Laboratory. You may reach Christopher atcwhaling@synthesispartners.com.

Christopher L. Whaling is co-founder of Synthesis Partners, LLC, a private business and technology analysis company based in Reston, VA. Mr. Whaling has lead assessment teams in all source research, analysis and delivery of technology and market intelligence decision-support products for 20 years. Recently, Mr. Whaling refined and implemented Natural Language Processing (NLP) technology to produce beta-level, scalable decision-support systems. Mr. Whaling has been invited to present analysis products, forecasting techniques and outcomes at the US National Intelligence Council (NIC), the Society for Competitive Intelligence Professionals (SCIP), the Washington Institute for Operations Research and Management Sciences (INFORMS), and the US Department of Energy’s Oak Ridge National Laboratory. You may reach Christopher atcwhaling@synthesispartners.com.

About the Newsletter

Editors-in-Chief

Jin-Woo Ahn

Co-Editor-in-Chief

Sheldon Williamson

Co-Editor-in-Chief

TEC Call for Articles 2023 - Advances in Charging Systems

The TEC eNewsletter is now being indexed by Google Scholar and peer-reviewed articles are being submitted to IEEE Xplore.

To submit an article click here.