Urban Trucks Will Eventually All Be Electrified, But Which Types Will Be First?

By Benjamin Jurjevich and Andy Swanton

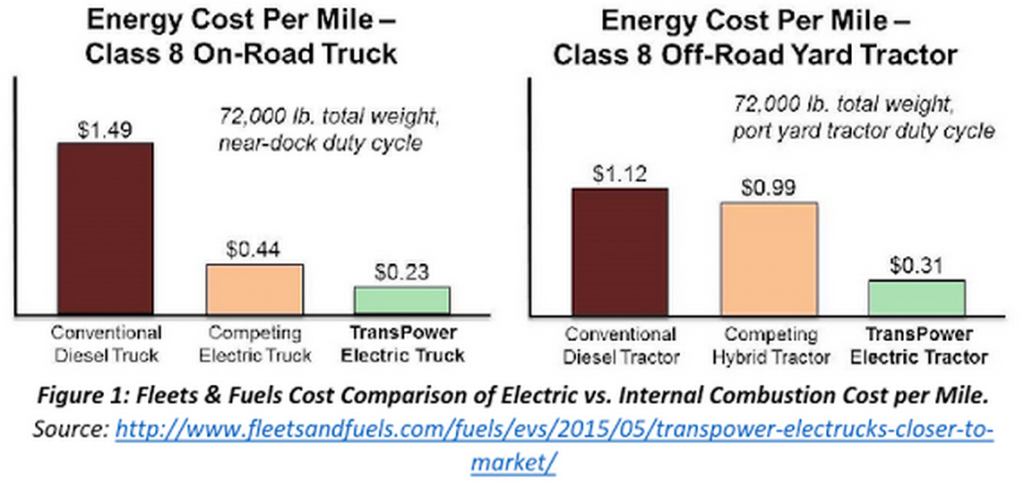

It is quickly becoming a common notion that the future of utility trucks will be zero-emission, battery-electric [1]. It is hard to dispute, especially when considering fixed-route urban services such as waste management trucks and street sweepers. Even low mileage utility trucks such as cement mixers and yard trucks are all presently integrated with truck chassis that have horrible fuel economies, often below 4 mile-per-gallon [2]. Last week, Fleets & Fuels published an article supporting the “electrified” business case and illustrating an example of a repowered TransPower Electric Truck that could payback conversion investments in as few as 150,000 miles [3]

The cost savings for the electric trucks are staggering – stemming mostly from fuel costs and high maintenance costs, the diagram depicts the existing cost burden on America’s fleet operators. Luckily, the world-wide electric truck markets are growing rapidly with many options now commercially available. There are new competitors in the marketplace offering off-read yard tractors and urban utility trucks with ranges in excess of 100 miles, like California manufacturer BYD Motors.

The Fleets and Fuels results are not only limited to class 8 trucks. A study conducted by the Georgia Institute of Technology showed electric delivery trucks use “30 percent less total energy and emit about 40 percent less greenhouse gases than diesel trucks, for about the same total cost, taking into account both the purchase price and the operating costs” [4].

This strong economic business case for electrifying trucks is also supported by the complete elimination of city/urban noise pollution and the quantifiable environmental impact electric trucks will bring. However, to places like densely populated urban cores, or logistics centers where hundreds of thousands of people must deal with dirty exhaust or smelly CNG fumes and extreme noise pollution from these internal-combustion-engine technologies, there is no question these external factors will drive electric truck adoption.

Now this begs the question, which truck models will be first?

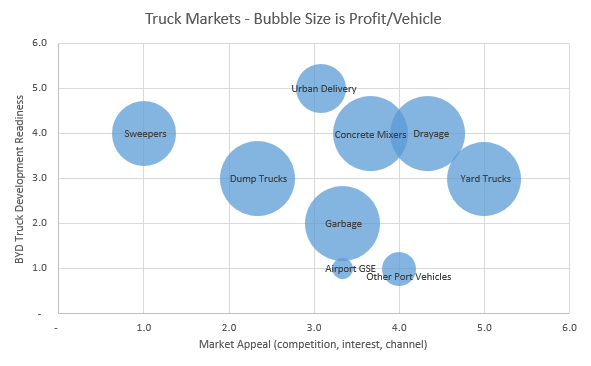

Figure 3: Electric Truck Adoption Market Analysis

Source: BYD Motors, Andy Swanton Director of Business Development

Above is a diagram created by Andy Swanton, the Director of Business Development for electric trucks at BYD Motors. In an interview with Andy, a simple question was asked, Which trucks should be electrified and why?

“Ask 10 people in the trucking industry and you’ll probably receive 10 different answers. Urban delivery trucks. Concrete trucks. Street Sweepers. Drayage trucks. The reason – unlike gasoline or diesel powered vehicles, there are a number of different motivators that influence customer interest and willingness to pay.“

Andy continued to describe four other key areas he believes will play a major role in how these vehicles are considered for diesel replacement:

1. Duty Cycle

“Range anxiety is a problem no matter which customer segment you’re talking to. Urban delivery trucks will drive different routes depending on the number and location of the deliveries. Concrete trucks will travel from the mixing plants to construction sites that could be located just about anywhere. U-Haul would have a tough time converting to electric because every customer drives a different number of miles. On the other hand, some customers have fixed routes with low mileage and are therefore more willing to entertain an electric vehicle. For example, trucks for refuse collection often will only drive 50 miles and the route is always the same.”

2. Customer Interest

“Almost every company has the word “sustainability” in their mission statement; however, when customers are forced to make tradeoffs between a green planet and green dollars, decisions typically follow the money. There are exceptions. Many for profit businesses are willing to prioritize zero emission vehicles for the benefit of the planet. UPS is one such example. Many organic food delivery services are interested. STAPLES, Frito Lay, and Coca-Cola have all purchased a number of battery electric vehicles that were more costly than diesel alternatives.”

3. Regulations

"Air districts across North America have been increasing their regulations with regards to truck emissions. For example, in 2008 the California Air Resources Board approved Truck and Bus regulation requiring privately and federally owned trucks to purchase new engines for diesel trucks over 14,000 pounds based on the age of the engine. As regulations increase in the various segments, customers are more willing to discuss electric options and many are attempting to make purchasing decisions in anticipation of tighter regulations.“

4. Path to Market

“Another factor is how easy it is to bring vehicles to market. Some customers, like the subcontractors who provide street sweeping services, are highly fragmented. This complicates the process of wide-scale commercialization as there are a great number of of decision-makers to convince. Other industries, like the refuse and airline markets, are highly consolidated and decision-making is made centrally. For these customers, one customer could lead to thousands of orders.”

Andy details more of BYD’s electric truck strategy and I got permission to state that BYD will begin showing their first heavy-duty electric trucks in the US markets in the fall of 2015, and to expect seeing offerings catering to refuse, construction, urban delivery, yard logistics and drayage.

Sources:

1. http://www.theicct.org/sites/default/files/publications/CE_Delft_4841_Zero_emissions_trucks_Def.pdf

2. http://www.nrmca.org/operations/Documents/2012FleetSurveyFinalRepot.pdf

3. http://www.fleetsandfuels.com/fuels/evs/2015/05/transpower-electrucks-closer-to-market/

4. http://www.news.gatech.edu/2013/09/25/diesel-or-electric-study-offers-advice-owners-urban-delivery-truck-fleets

Ben Jurjevich is an Engineering Associate in electric truck development at BYD Motors. He studies Integrated Engineering and Business at the University of Western Ontario. His field of research is in large-scale transformative technologies.

Ben Jurjevich is an Engineering Associate in electric truck development at BYD Motors. He studies Integrated Engineering and Business at the University of Western Ontario. His field of research is in large-scale transformative technologies.

Andy Swanton is Director of Business Development at BYD working on bringing full battery electric trucks to market, including everything from on-road delivery trucks to off-road heavy duty freight trucks. Prior to BYD Andy worked for a medical device manufacturer in Glendora, CA, where he worked in a variety of commercial and operational roles. Before that he was a water treatment engineer, designing and overseeing construction for municipal water treatment projects. Andy has engineering degrees from Tufts University and MIT and a MBA from the Harvard Business School. He currently lives in Los Angeles with his wife, Kellie, and golden retriever, Zoey.

Andy Swanton is Director of Business Development at BYD working on bringing full battery electric trucks to market, including everything from on-road delivery trucks to off-road heavy duty freight trucks. Prior to BYD Andy worked for a medical device manufacturer in Glendora, CA, where he worked in a variety of commercial and operational roles. Before that he was a water treatment engineer, designing and overseeing construction for municipal water treatment projects. Andy has engineering degrees from Tufts University and MIT and a MBA from the Harvard Business School. He currently lives in Los Angeles with his wife, Kellie, and golden retriever, Zoey.

About the Newsletter

Editors-in-Chief

Jin-Woo Ahn

Co-Editor-in-Chief

Sheldon Williamson

Co-Editor-in-Chief

TEC Call for Articles 2023 - Advances in Charging Systems

The TEC eNewsletter is now being indexed by Google Scholar and peer-reviewed articles are being submitted to IEEE Xplore.

To submit an article click here.