Electrified Public Transportations Promises Residual Value

By Micheal Austin

Sustainable transportation, while initially costly to implement, has long term benefits not just to the environment, but also represents additional opportunities through emerging battery technology that can be transferred to other energy applications beyond moving people around in urban areas.

While consumers still struggle with return on investment for electric vehicles and the perception that they aren’t viable for travel outside urban areas, public transportation around the world is moving at a much faster rate of adoption.

Countries and municipalities are seeing the benefits of powering fleets of buses and taxis with electricity because it’s become clear the infrastructure to support electrified public transportation, particularly battery-operated vehicles, is feasible, achievable and affordable. In addition, these buses and taxis are quiet and emissions free, making them the epitome of sustainable transportation especially in densely populated areas.

Sustainable transportation can also have broader implications, according to a recent report released by the International Energy Agency, which found that policies that improve the energy efficiency of urban transport systems could help save as much as $70 trillion in spending on vehicles, fuel and transportation infrastructure between now and 2050. The report, “A Tale of Renewed Cities”, looked at more than 30 cities across the globe to show how to improve transport efficiency through better urban planning and travel demand management. Lower greenhouse-gas emissions and higher quality of life were among the benefits.

Research released last fall by Frost and Sullivan found that urbanization is placing a huge strain on cities’ infrastructure and public transit, and consequently, creating environmental concerns for governments. As a result, the firm said, they have to make significant investments in upgrading infrastructure, but this is hampered by their dependence on fuel imports, volatile fuel prices, and increasing reliance on conventional fuels.

The report said the transportation industry, especially the transit bus sector, will have to adapt to newer powertrain systems and other advanced technologies, such as connectivity and hub-and-spoke multi-modal urban mobility, to attain sustainable growth and economical passenger mobility. The research found that hybridization and electrification of powertrain is set to become a global phenomenon in transit buses by 2020, with the world’s heavy-duty transit bus market indicating that sales of hybrid and electric buses will grow at a compound annual growth rate of 20.6% percent by 2020. It is estimated that global penetration of hybrid buses will reach 9.7% percent by 2020, while electric buses will attain 5.7% percent penetration.

Developed countries all over the world have already started adopting advanced powertrains, such as hybrid and electric buses drives for transit buses, to reduce emissions and fuel consumption. These green powertrain systems are expected to improve fuel efficiency, and hedge against hikes in fuel price and ridership cost.

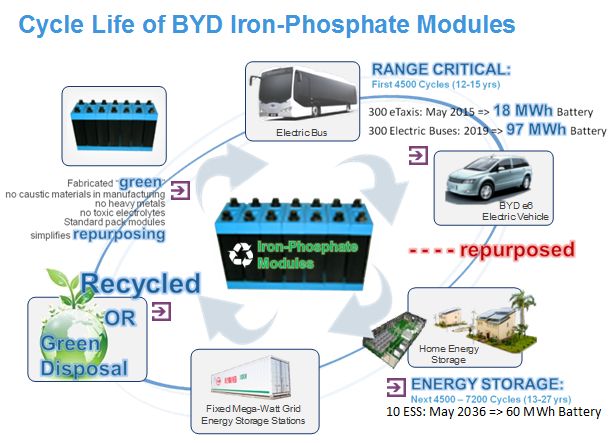

Meanwhile, battery technologies are evolving in such a way (with significantly extended service life out to 30 years) that they can be repurposed once these electric vehicles are retired, creating residual value that improves both return on investment and total cost of ownership, and thereby driving down the cost of renewable energy.

Some countries are moving faster than others when it comes to electrified vehicle transportation for public transit. Research by the International Energy Agency projects that only 6,400 buses the United States will be electric or hybrid vehicles by 2020, while China will have 73,000 on the road by that time. It is expected that 15 to 20 per cent of those buses will be electrified in some way. That means that of the 280,000 buses that will be replaced in 2020, up to 50,000 electrified buses will be purchased.

In 2012, the bus market was heavily dominated by Chinese vendors, while Volvo is also well-represented across all segments. There were some North American vendors as well, some of which have been acquired or exited the market. Most of growth is happening in China and Latin America, with some upticks in Europe. However, growth in the United States and Canada is only starting from 2014.

The success of transit bus systems in North America and Europe depends on public perception. Promoting transit buses as an environmentally friendly, convenient, and economical mode of transport can help bring in more ridership and encourage a switch from personal to public transport, as Frost and Sullivan noted in its research.

One of the challenges facing the adoption of electric vehicles, whether it’s cars for consumers or buses for public transportation, is changing the perception that they can go a significant distance without needing to be recharged. In fact, some buses on the market today can travel up to 24 hours on a single battery charge.

There are buses with battery packs as large as of 550 kWh (a half a Mega-Watt-Hour). This means a loaded 40-foot bus, with air conditioning, can travel an average of 155 miles (far exceeding routes in most large dense cities). The bus shown below is a 60-foot articulated bus that can transport 120 passengers 170 miles with a single battery charge.

In regions that don’t require a bus to run air conditioning, the distance they can travel on a single charge can be well over 200 miles. Buses running in the colder areas like Montreal or Edmonton, for example – are capable of travelling 140 miles with electric heating in full function. Passenger-compartment electric-heating does impact bus range, unfortunately. In heating, there is no duty cycling that you experience with air conditioning for cooling in the summer months. Resistive heating draws the range down very quickly so alternative “clean-fuel” heating sources have been developed for frigid regions.

Battery packs in these buses are BYD Iron-Phosphate-based with 6,000 to 7,000 cycles. These buses have aluminum bodies and are purpose-designed specifically as electric vehicles with two, in-wheel hub motors, so they don’t have to have space allocated for traditional transmissions, powertrains or clutches and as a result have lower floors because there are no axels.

There are electric taxis in mass-production with 60 kWh Iron-Phosphate power modules that can go 186 miles (farther without air conditioning). They experience the same type of range loss, however, in the winter when heating is in operation. But even during the recent “2014 polar vortex” in Chicago, my Iron-Phosphate-powered BYD e6 could still go 140 miles per charge with heating on all of the time.

There are several major electric taxi fleets outside of China using Iron-Phosphate powered, five passenger, cross-over sedans; ~50 cabs operating in London, ~50 in Bogota, >100 in Hong Kong, up to 50 in Rotterdam and several in Chicago and New York. And it’s not just limited to taxis — there are 500 electric-powered police cars operating in Shenzhen, China, in addition to the over 2,000 eTaxis.But just because these vehicles only can only drive a certain distance on a single charge does not mean they only go that distance in a day. Just like our smartphones, the cars charge when they have downtime. Electric taxis that only go 180 miles on a single charge, for example, are traveling an average of 300 miles in a day in Shenzhen, thanks to opportunity charging.

|

|

A Shenzhen taxi driver starts their day fully charged. But at every opportunity they charge up – when the driver stops for a bathroom break, the cars plug in. When they go on lunch breaks, they plug in. When they are sitting in the taxi queue, they are plugged in. Most taxis are idle 40 per cent of the time, and if they are petroleum-powered, then they are creating pollution and consuming fuel. Electric taxis in Shenzhen pay nine cents a kilowatt hour to rapid-charge at 114 different rapid charging megaplexes (they only pay four cents a kilowatt hour for night-time charging). A rapid charge of 50% percent can add another 100 miles of distance in about eight minutes of charging time (SOC 15 swings up to 65).

And that’s where the return on investment comes into play. If they drive that 100 miles per day for 20 days they literally pay off the $550 dollar lease rate in their fuel savings. The taxi is literally free for them because they’ve saved more in fuel than they would have paid driving a Camry at 26 miles per gallon. Opportunity charging makes that possible. (Read here for ROI details: http://www.businesswire.com/news/home/20121108007021/en/Free-Phones-Free-Taxis-BYD-China-Development )

That same technology is available in the United States, whether its taxis, buses or consumer electric vehicles with wireless inductive charging – there are no bus routes in the United States that couldn’t be completed with today’s electric bus. The technology is here for electrifying public transportation seamlessly with buses that are more reliable than any complex internal-combustion and transmission powertrain.

Since the first electric taxis launched in Shenzhen in 2009, many single taxi vehicles have travelled approximately 370,000 miles (or 600,000 km). After five years of operation, some of the cars are now being retired from revenue service. Retired battery packs are being tested with still 92% percent of their original capacity, which means they can be repurposed with significant battery life remaining. And while they would not be recertified for a ‘range-critical’ application (like another EV), they could be used in home energy and fixed energy storage applications. This repurposing of batteries lends itself to driving down the cost of all renewable energy which completes a truly zero-emissions eco-system.

Jurisdictions around North America are testing and deploying battery-powered buses, including Ottawa, Edmonton, Palo Alto, Montreal and Los Angeles. There are several brands of electric buses now in revenue service around the United States – Stanford University’s zero-emission fleet is now traveling over 10,000 zero-emission-miles a month. Colombia and Brazil have been deploying electric buses as a part of their Bus Rapid Transit (BRT) systems that combines the capacity and speed of light rail or a metro with simpler-to-implement (rail-less) bus systems. Larger scale bus fleets can be found in China, Europe and Latin America.

Total cost of ownership is particularly important in public sectors. Diesel buses (at $450,000) have a lower initial bus cost than a natural gas bus at about $500,000 and electric buses are about double the initial cost of a diesel bus (at $850,000). However, when you factor in fuel savings, maintenance savings and environmental costs, particularly in a jurisdiction that has green-house-gas (GHG) emissions taxes such as California, over the 10-year lifespan of an electric bus, the savings amounts to approximately half a million dollars (PER-BUS if you electrify and replace one diesel bus). If you don’t have a transmission to maintain, or 50 gallons of oil that need you be flushed through your system every five weeks, including the labor costs associated with those oil changes, or as much brake wear, there’s a lot of maintenance savings in an electrified platform that can be realized.

One innovation that should be noted as well is that by moving to AC charging, it’s possible to support vehicle-to-vehicle charging, so a stranded bus on a route doesn’t require a special generator to charge it up again; another electric vehicle can be dispatched to recharge it. A 60 kWh Iron-Phosphate battery in a taxi can charge a bus with enough energy to get it back to a bus garage for charging.

This technology lays the groundwork for vehicle-to-grid applications. Buses could conceivably become an asset to a utility. When Los Angeles Metro launches their first 10 electric buses, that’s literally 3.6 megawatt hours that’s attached to the grid at night. These assets don’t have to be only “public transportation assets”, they can also be “public utility assets” as well – 24 hours per day. And if you begin to look at these batteries as truly “public assets”, not just being used for transportation during the day but utility assets at night, you can see the larger up-front costs spread over more functions.

The evolution of financing batteries for vehicles does not need to be dissimilar to that of how we financed mobile phones. When the Motorola RAZR was offered “free” with a two-year service contract, new subscribers climbed to more than four million a month. By finding creative financing, batteries will also allow the adoption rates of electrified transportation and renewable energy to climb in a simliar fashion.

We need to think creatively on how to finance electrified vehicle transportation systems, specifically the battery (the most expensive single component of an electric vehicle). The cost premium could be absorbed by considering the residual value of the battery at end-of-life. By creating an after-market, we could resell and repurpose EV batteries for renewable energy. The three-hundred taxis in Shenzhen that come out of service in and around 2015 (after five years in service) represent 18 megawatt hours of batteries, which by-the-way are already fully depreciated in their first purpose. The 300 Shenzhen buses launched in 2010 represent 90 megawatt hours of batteries that should come available in 2018. They aren’t free, but they are fully-depreciated so they are nearly free.

They can be recertified at lower capacities for new uses. This translates into a huge amount of batteries very soon that can be sold into the energy storage market. That changes the entire equation. By selling the batteries, even at only 10 cents on the dollar, it creates a residual value that can be applied to offset the original cost. That’s how we get a $10,000 consumer electric vehicle because you have the means to repurpose the battery for large-scale applications tied to solar or wind for base-load generation later. If you look at batteries differently, and use a battery that has a very long lifecycle (like with 92% percent capacity remaining when the vehicle is retired) then the residual value is very meaningful.

Ultimately investment in sustainable public transportation, particularly electric vehicles and taxi cabs, will not only have a positive impact on the environment while in service, but also have broader implications for power generation in other applications beyond their lifecycle and offer a value chain that can drive down the cost of renewable energy and make it more relevant in our future.

MICHEAL AUSTIN — Vice President – BYD America

MICHEAL AUSTIN — Vice President – BYD America

Micheal Austin received his degree in Design Engineering as well as a Masters Degree in Mechanical Engineering from BYU. He worked for Motorola 15 years in functions including ODM Director for the Mobile Devices Business responsible for over $3B in purchases annually and serving as Motorola’s Global Energy Commodity Manager, purchasing Motorola’s battery products. He was selected as Motorola’s Distinguished Innovator (with 22 US patents) in 1999. He has considerable Asian International business experience which proves invaluable in his current role as Vice President for BYD America. BYD is a $40B Chinese company listed on the HKE and has over 200,000 employees.

About the Newsletter

Editors-in-Chief

Jin-Woo Ahn

Co-Editor-in-Chief

Sheldon Williamson

Co-Editor-in-Chief

TEC Call for Articles 2023 - Advances in Charging Systems

The TEC eNewsletter is now being indexed by Google Scholar and peer-reviewed articles are being submitted to IEEE Xplore.

To submit an article click here.